We’re all ears! For any queries, call us on 02269821111 (Mon to Sun, 10AM - 7PM)

- Products

- Offers

- Blog

- For Businesses

We’re all ears! For any queries, call us on 02269821111 (Mon to Sun, 10AM - 7PM)

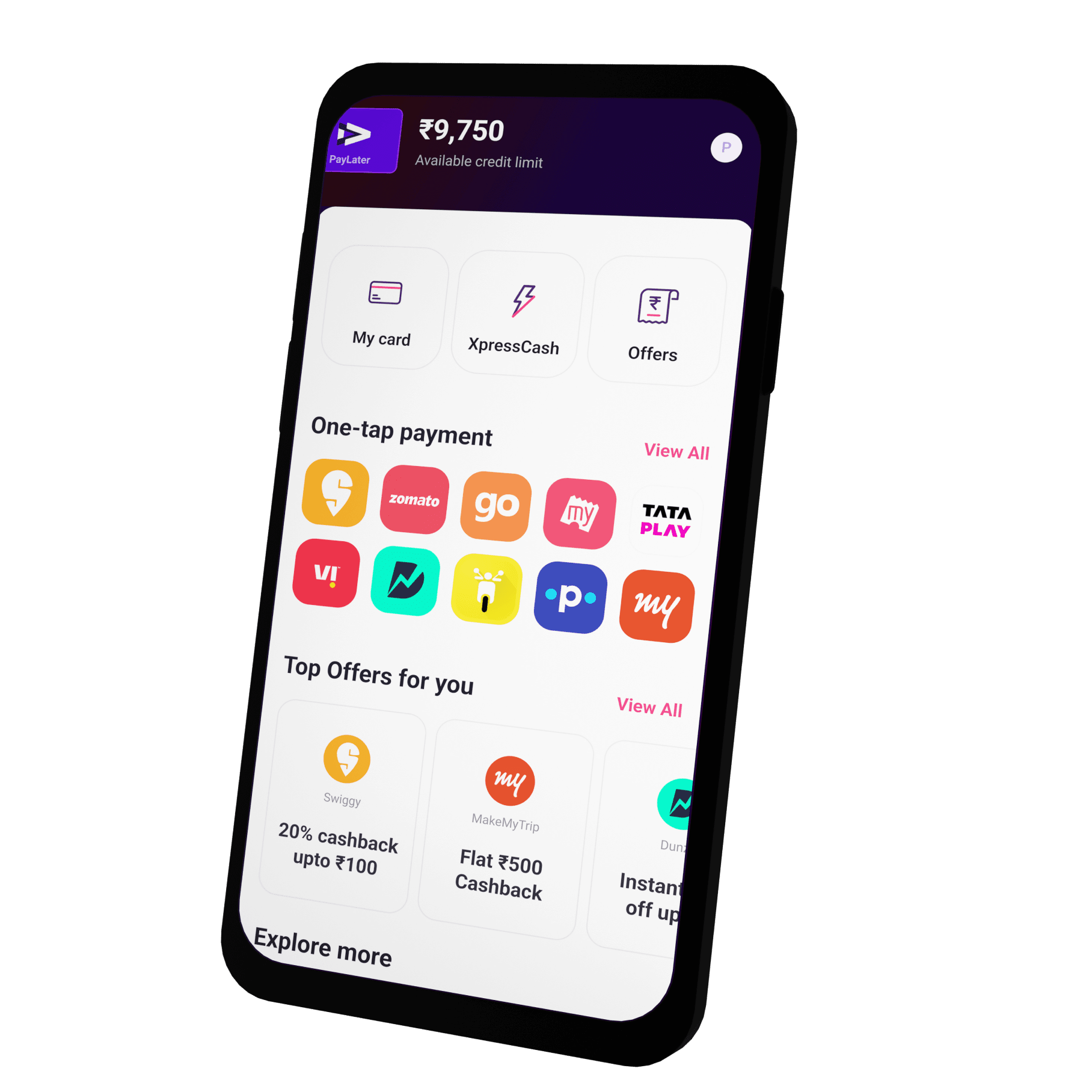

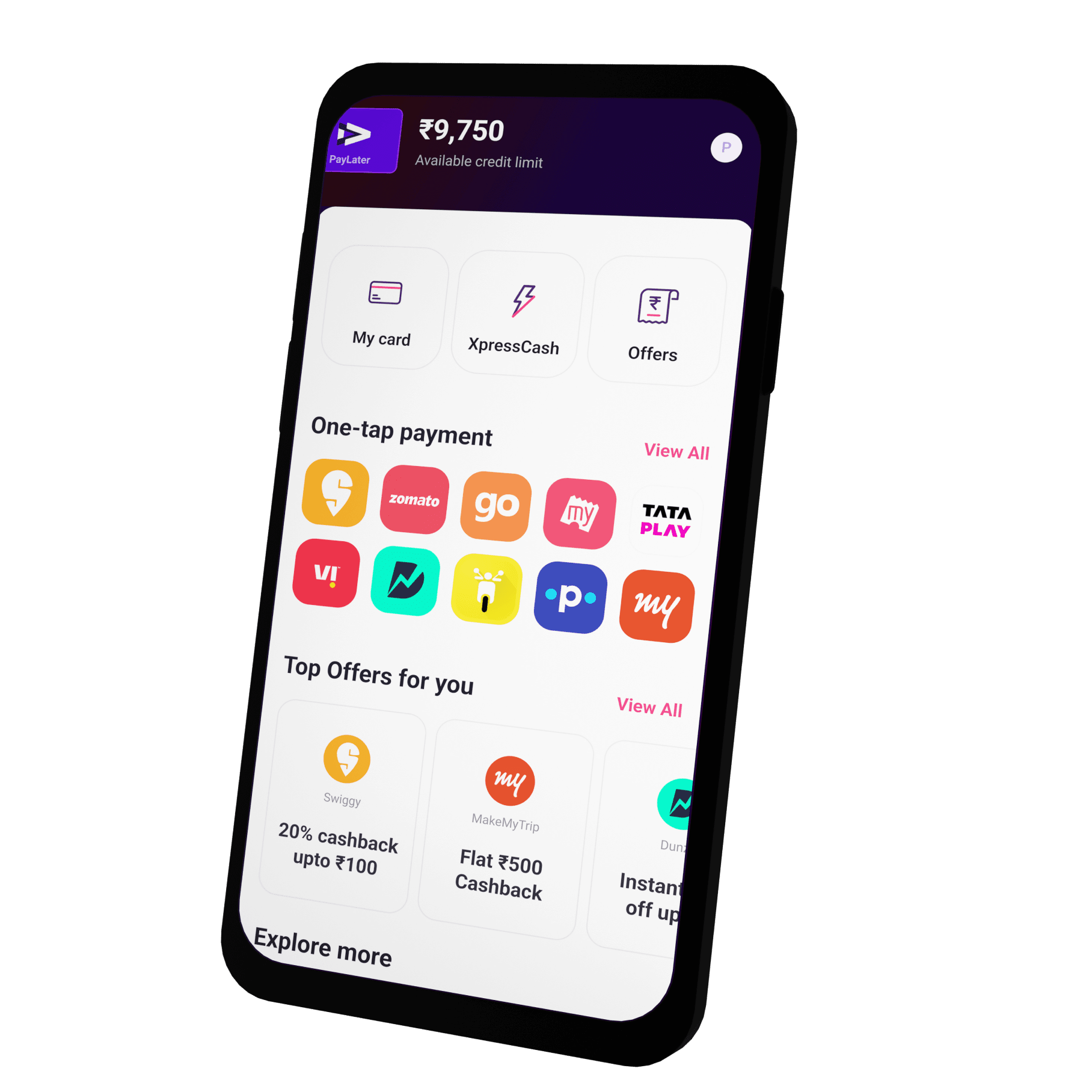

The LazyPay Credit Universe

Checkout in 1-click. Pay 15 days later.

Lightning fast cash. Zero physical paperwork.

Checkout in 1-click. Pay 15 days later.

Lightning fast cash. Zero physical paperwork.

Infinite options to shop!

Use your LazyPay Credit offline and online - across millions of merchants

We’re making you offers you can’t refuse!

You keep us going ❤️

I have been using Lazypay from the past 2 to 3 years. This is the best buy now pay later app I have been using. As compared to other BNPL like Simpl, Mobikwik, Paytm Postpaid, etc., I use this more due to UPI ID convience . I’m still waiting for Lazycard. I’m excited to get it into my hands.

Kurapati V

Age - 23

I have been using Lazypay from the past 2 to 3 years. This is the best buy now pay later app I have been using. As compared to other BNPL like Simpl, Mobikwik, Paytm Postpaid, etc., I use this more due to UPI ID convience . I’m still waiting for Lazycard. I’m excited to get it into my hands.

Kurapati V

Age - 23

Parent Companies

Download the LazyPay app to get started

or get the link on your phone

Download the LazyPay app to get started

or get the link on your phone

About LazyPay

LazyPay Private Limited is a private limited company incorporated under the provisions of Companies Act, 2013 and is engaged amongst others in the business of providing technology enabled settlement services, settlement processing services together with certain collection services to different kinds of business entities, and marketing/distribution of co-branded prepaid payment instruments.

Products offered:

a. Personal Loans: If you have the LazyPay app, you can secure a personal loan instantly up to Rs. 1 lakh. How? You only have to key in some basic information to know your unique credit limit. One of the biggest advantages is that you can get personal loan approval instantly for amounts as low as Rs. 10,000 or Rs. 20,000 going up to your credit limit. The interest has to be paid only on the amount of the loan that you have obtained, and repayment can be made in a highly convenient manner. You can choose from flexible EMI plans that cover around 3-24 months. The rates of interest usually range between 15% and 32%. There is a 2% processing fee on the amount withdrawn.

b. Buy Now Pay Later: With this mechanism in place, you can easily do your shopping online through 100+ merchants and choose the Pay Later option when you are checking out. Before this, you only have to key in some basic information and also get your credit limit checked. There will be a consolidation of all transactions into one LazyPay bill. This bill will have to be paid on the 3rd and 18th dates of each month. You will receive reminders on a regular basis courtesy LazyPay in addition to being able to track your spending and being enabled to make fast repayments.

c. No-Cost EMI: You can indulge in shopping to your heart’s content across your preferred stores online, including the e-commerce giant Flipkart and Amazon. You can make payments later via no-cost EMIs or low-cost EMIs which is truly a blessing for most of us! The EMI plans available are flexible and easy to avail and help us get things we like today without having to pay up instantly. No credit card is needed, and you can say goodbye to exorbitant interest rates. Blessing, right? You can sign up by choosing your preferred online store for transactions and key in the amount that you will be spending on shopping. Thereafter, you should choose your desired plan and apply online instantly for EMI offers ranging from 3-6 months and even 9-12 months. Post getting your application approved, you will get a voucher code. You can use the code to shop at your chosen online store. The no-cost EMI feature is really helpful.

d. Scan & Pay Later: LazyPay introduces a new feature of Scan & Pay Later, through which, you can transact on every merchant listed that accept UPI. All you need to do is get a Virtual Payment Address (VPA) from LazyPay that enables you to make purchases up to your credit limit. You can also avail the benefit of credit via ‘Scan & Pay’ feature, where you can buy the product you want and choose to pay within 15 days without any interest. Similarly, the credit can be converted into easy EMIs. Follow a few simple steps and avail the service.

Open your LazyPay app and activate your personalized VPA handle

- Now, your phone can be used as a credit card that allows you to make cashless transactions

- Scan the code and pay using VPA, that too online as well as offline

Yes, it works both ways. Be it anything; if you are in a coffee shop and don’t have enough cash, you can ‘Scan & Pay’. If you suddenly recall that you don’t have change for the auto fare, you can ‘Scan & Pay’. If you wish to buy your desired mobile from Croma, or even looking forward to paying your electricity bills, you can just ‘Scan & Pay’. That’s all you need to do. The only requirement is the merchant whom you are dealing with must have a UPI provision.

For obtaining fast approval and increasing your limit on LazyPay, there are certain criteria to be met. These include the following:

1. You are required to be a salaried professional.

2. You should reside in a major tier-1 or tier-2 city of India.

3. You should be between 22-55 years of age.

4. You should be an Indian resident.

You will also require these documents for completing the sign-up procedure:

- Proof of Photo ID

- Proof of Address

- A Selfie

- Details of your bank account, i.e. IFSC code and account number

Why LazyPay?

- Transparency: A fully digital process, that includes eligibility checks for limits in a few minutes and requires only basic information. So, you don’t have to go anywhere to submit any documents.

- Safety and security: The entire mechanism is guarded by highly advanced safety and security measures.

- Convenience: There is negligible or minimal documentation needed, and customers can access funding by submitting only their Aadhar Card, PAN Card and their photograph.

LazyPay is thus always at your beck and call with fast and ultra-convenient credit offered online and disbursed in a seamless manner. Shop from favourite online stores and pay later with flexible and low cost/no cost EMI plans. You can repay in 6, 9 and 12 months at affordable rates of interest.

The Buy Now Pay Later feature is really handy for today’s millennials who need to shop instantly for varied items.

LazyPay had its roots in the aim of lowering the overall friction and hassles related to checking out with online payments. This included making digital payments and transactions much easier and convenient for those customers who have amounts between Rs. 200 and Rs. 2,500 to contend with. There is chiefly the option to pay later. This is a one of its kind deferred payment facility offered to users and is a welcome offering. People can easily pay later while gratifying their needs today without having to wait. Also, depending upon the behaviour of customers, the facility can be extended for amounts starting from around Rs. 3,000 and going up to even Rs. 10,000. Thus as you can see, buy now pay later is a handy facility that you can avail instantly here.

Several apps and websites that have integrated the product will show LazyPay as payment option whenever you are going to the checkout process. By means of this, you can get a deferred payment facility for a period of 15 days along with a limit for transactions which is worked out based on the buying patterns of customers. They do not have to put in any information like their net banking details or debit/credit cards information. Moreover, the transactions do not need any passwords, OTPs or wallet recharges. This makes all the transactions really fast and smooth while ensuring that there are no failures of any banking transactions.

The company wishes to offer a world-class experience to Indian customers while also enabling conversion at a larger scale. Additionally, LazyPay can be perceived as the ideal platform for the core values followed by the company, i.e. simplification of the entire process of online payments for customers where there is a clear distinction between payment and buying activities and also where the buyer gets the facility of deferred payments.

LazyPay went live in March 2017, and has already garnered positive responses from its users. Users can use the LazyPay across 250+ merchants including Swiggy, MakeMyTrip, BookMyShow, Zomato, Gaana.com, Goibibo, TataSky, BigBasket, Flipkart, Rapido, Box8, Dunzo and many more.

With payments ranging between Rs. 200 and Rs. 2,500, it has been observed that users usually want to make online payments using credit for a wide range of things including smaller utility bill payments, buying groceries online along with ordering food online and also for getting cinema tickets. LazyPay has a unique pre-decision mechanism whether any customer has ample eligibility for any transaction. Users are thus selected based on their trust score, which is worked out on the basis of the online purchases and transactions that they have made overall. Numerous customers have obtained eligibility under LazyPay till now, and there are specific algorithms which have been implemented in order to ensure quality underwriting on a real-time and highly dynamic basis. Once users are eligible, they can easily opt for the buy now pay later mechanism and seamlessly pay later for their purchases.