With numerous responsibilities and limited funds, it becomes crucial to apply for a personal loan. Although one can anticipate and prepare for significant life events such as marriage, studying abroad, or purchasing a new house, unforeseen circumstances can arise, catching you off guard and depleting your savings.

While specific individuals choose to establish instant funds or XpressLoan for such situations, many prefer the convenience of securing a loan with LazyPay.

What is Personal Loan?

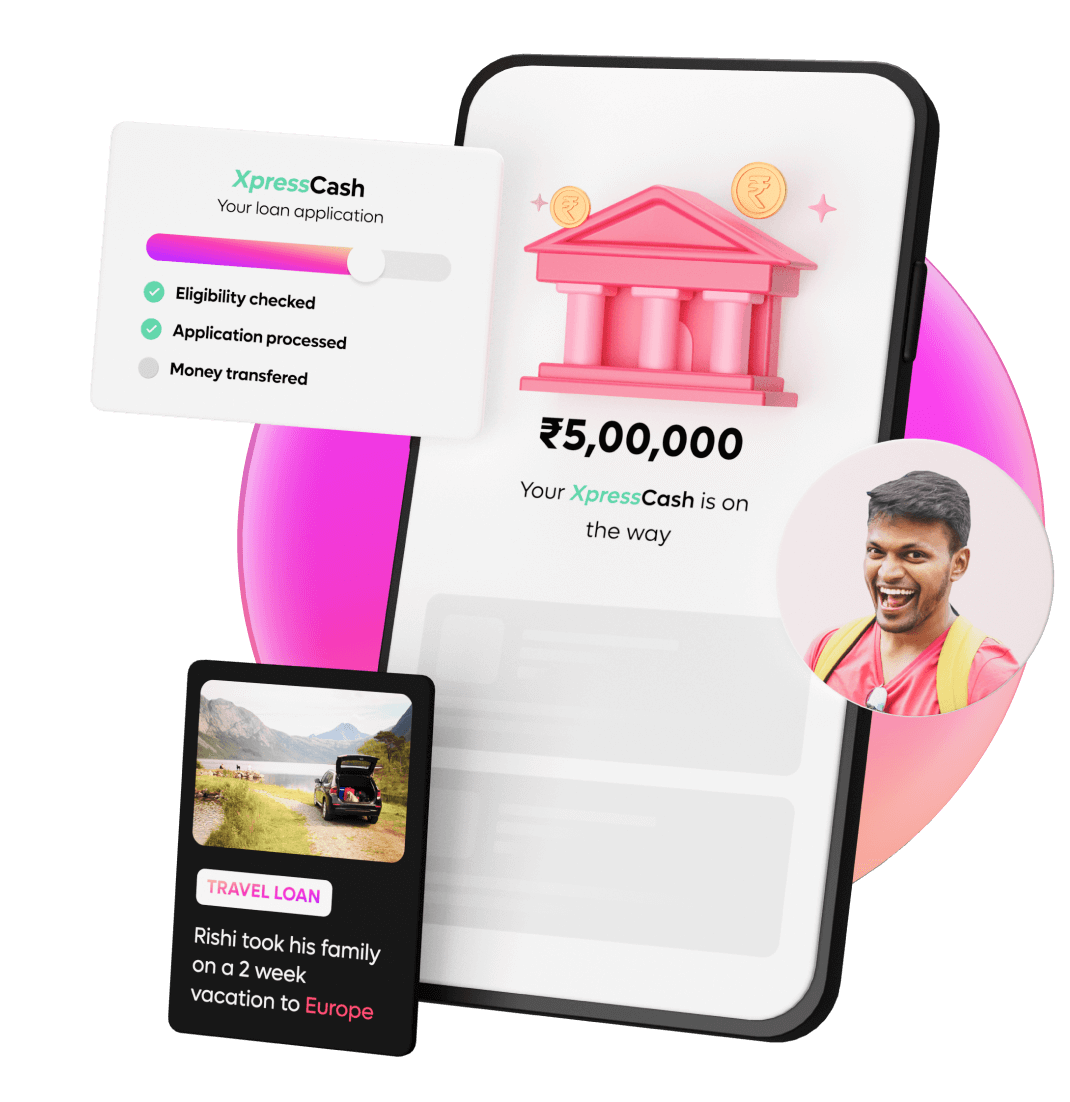

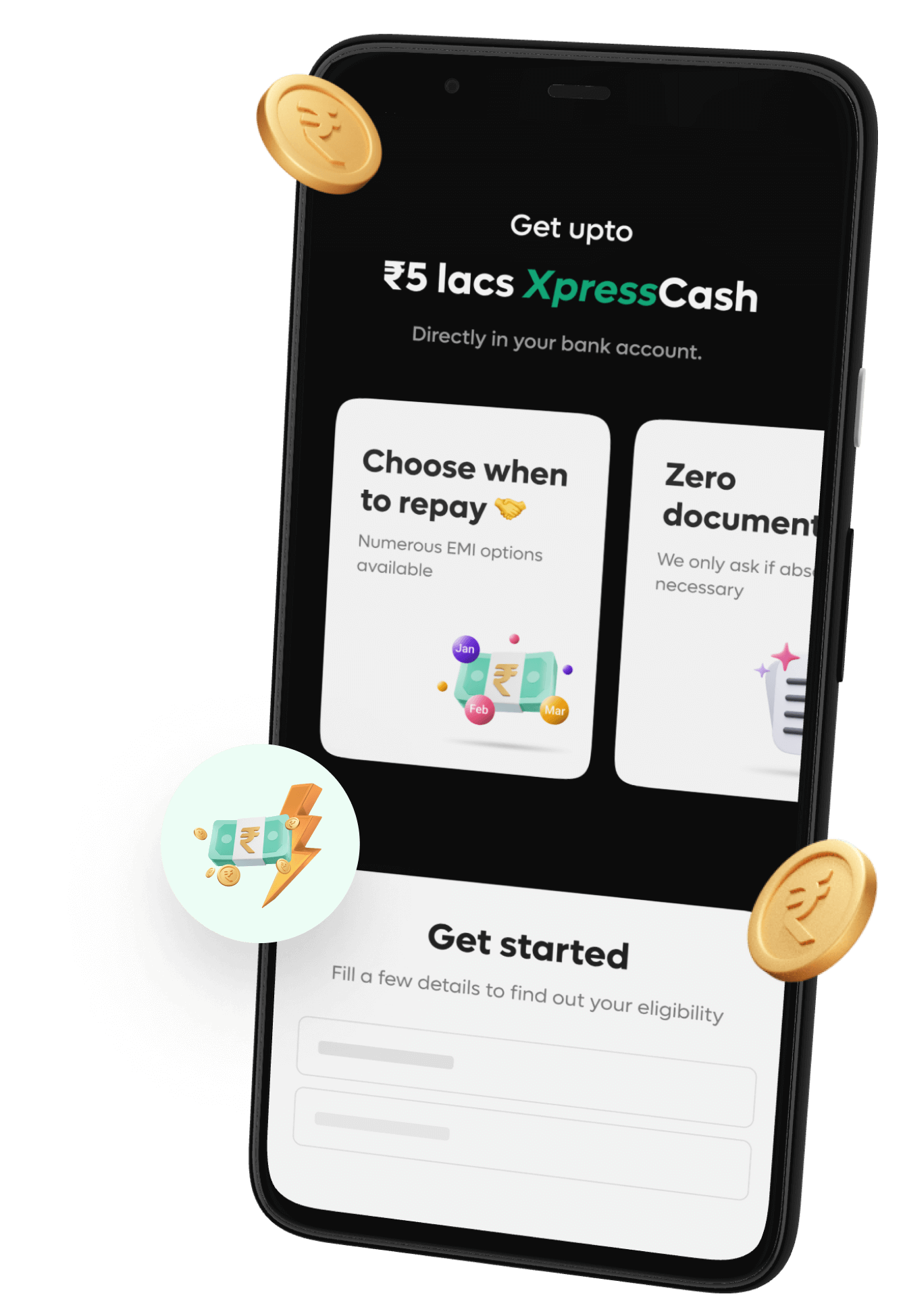

When you need financial assistance, apply for a personal loan to acquire the necessary funds that can cover various expenses, whether planned or unexpected. These loans can be broadly categorized into two types: secured and unsecured, depending on the loan amount, duration, and purpose. However, with LazyPay, you can apply for a loan that is unsecured, which means you don’t have to pledge any collateral. This gives you complete freedom to borrow up to Rs. 5 lakhs!

Personal loans are commonly utilized for a range of personal reasons. They can be used for marriage, home renovation, travel, education, two-wheeler, or even medical loans. The borrowed funds can also be employed to cover expenses related to relocating to a new city, changing jobs, or purchasing high-value electronic items like smartphones or appliances.

Effortless Access to XpressLoan with LazyPay

With LazyPay, you can apply for a personal loan through our seamless digital process. Just sign up using your mobile number and check your available limit, which can even be increased up to Rs. 5 lakhs!

Are you looking for quick and convenient credit online? Look no further!

This personal loan app is a platform that understands the importance of instant credit, so we extend loans to individuals like you looking for quick financial solutions. You can complete your KYC within the app and use your limit as a personal loan to meet all your financial expenses.

And the best part? We offer instant approvals and fast disbursals, so your XpressLoan will be ready to be credited in your bank account without needing multiple bank visits or a lengthy documentation process. We also provide flexibility in repayment options. For example, you can choose a convenient repayment period ranging from 3 to 24 months at affordable interest rates. Plus, you’ll only pay interest on the borrowed amount, not the entire available credit limit.

So, are you ready to experience the fastest way to get XpressLoan? Then, instantly apply for a personal loan with LazyPay today and enjoy our convenience and speed!

What can you utilise XpressLoan for?

When you decide to apply for a loan, XpressLoan brings you a wide range of possibilities. So whether you need funds for a wedding, home renovation, travel expenses, education costs, a new two-wheeler, or medical bills, XpressLoan is the solution you’re looking for.

Additionally, suppose you’re planning a move or a career change or want to purchase high-value electronics like smartphones or appliances. In that case, you can rely on instant personal loans by LazyPay to provide the financial support you require.

Apply for a loan at LazyPay effortlessly to gain the flexibility to fulfil your personal goals and meet your financial obligations.

Why should I opt for a LazyPay personal loan?

Choose the Quickest Online Loan Process with LazyPay for the following reasons –

1. Seamlessly digital: Skip the bank visits and apply for a personal loan online.

2. Go 100% Paperless: Effortlessly complete the application process within the LazyPay App with minimal documentation when you apply for a loan.

3. Pay Interest Only on the Borrowed Amount: Enjoy flexible and transparent interest rates.

4. Collateral-Free Personal Loan: No security is required for your loan amount.

5. Stay in Control: Track Spending Limits, Application Status, EMIs Due, and more on the user-friendly iOS and Android app.

6. Instant Help at Your Fingertips: Resolve queries on the go with direct assistance from the app

7. Restore Your Credit: Timely repayments help rebuild your credit score.

How do I apply for a LazyPay personal loan?

Apply for a Personal Loan with LazyPay in simple steps –

Step 1: Sign up, Check the Eligible Limit, and Activate in Minutes

Step 2: Unlock your personalised limit by signing up on the app and providing your PAN details. Instantly discover how much you’re eligible for!

Step 3: Simply submit your KYC details to activate your enhanced limit. It’s a quick and hassle-free process.

Step 4: Next, complete your auto bill payment setup and you’re all set when you apply for a loan instantly.

Step 5: Now, you can utilise your enhanced LazyPay credit limit as an instant loan. Alternatively, convert it into No-cost EMIs when shopping with partner merchants or enjoy the convenience of “Buy Now, Pay Later” with just a single tap!

Affordable interest rates for unparalleled experience

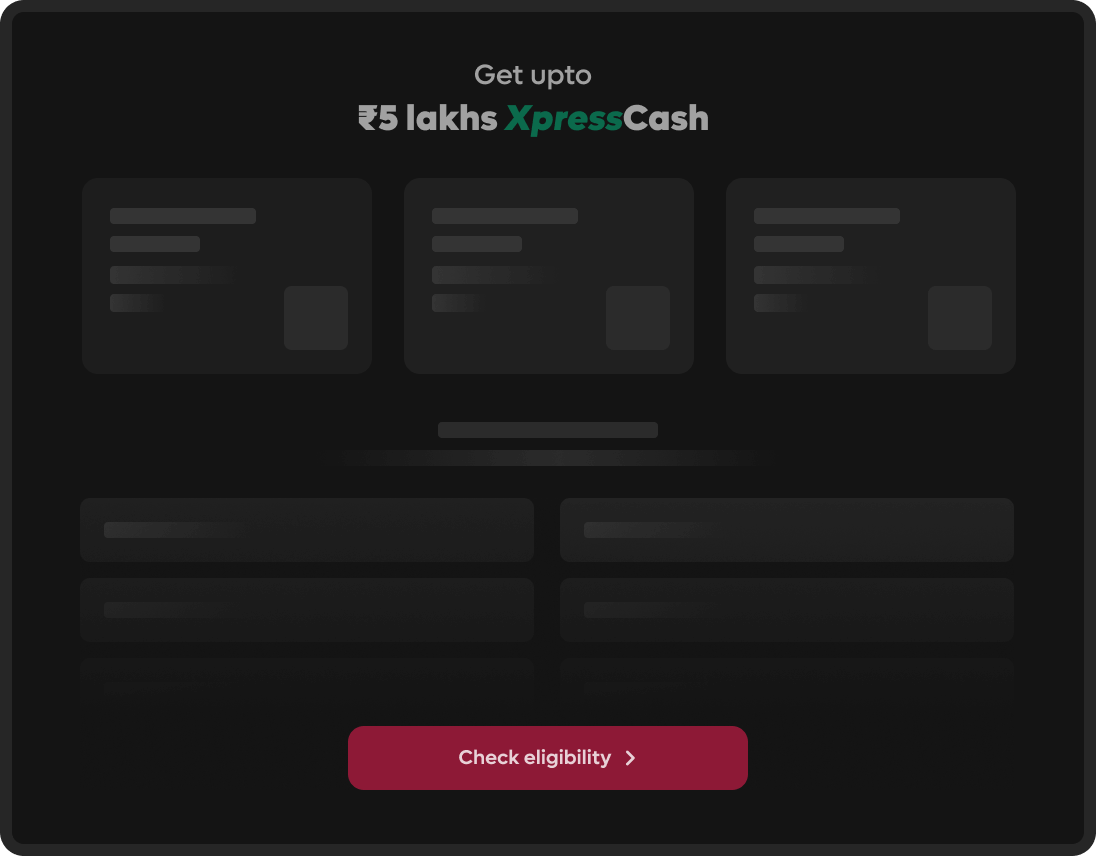

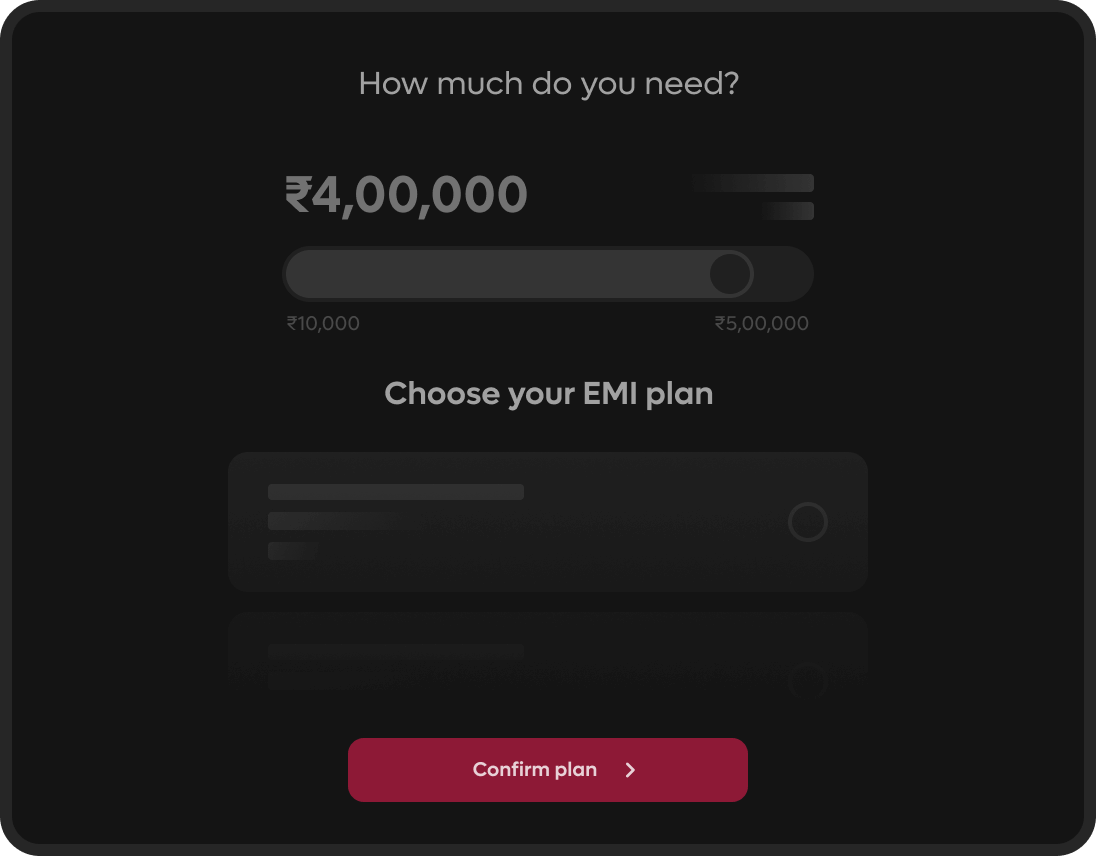

Discover a seamless experience when you choose to apply for a loan through LazyPay. With LazyPay, you can enjoy the flexibility of selecting a tenure that suits you best, ranging from 3 to 24 months. What sets LazyPay apart is its commitment to providing affordable interest rates that are specifically tailored to match your preferred Equated Monthly Installment (EMI) tenure and risk profile.

One of the major advantages of opting for a loan through LazyPay is that you only pay interest on the amount obtained. This unique feature ensures that you have the flexibility to borrow what you need, minimizing the burden of unnecessary interest payments.

Repaying your loan with LazyPay is designed to be highly convenient. The platform offers various convenient repayment methods, making it easier for you to fulfill your obligations. Whether you prefer automatic deductions, online transfers, or other payment options, LazyPay strives to provide a seamless repayment experience that suits your preferences.

Please note that a minimal processing fee will be applicable on the amount withdrawn, ensuring a hassle-free borrowing experience.

What are the documents required for a LazyPay personal loan?

Keep the following items ready while you start the process on our personal loan app:

- PAN Card

- Identity proof & address proof (Aadhar Card)

- Bank details for repayment setup

- Pen & paper for signature upload

On completion of your application, your approved credit limit will be ready to seek a loan apply instantly and anytime!

Remember to make timely repayments, check your progress in the app and continue to enjoy the convenience of credit on tap!

So, what are you waiting for? Apply for a personal loan at LazyPay today!

Tips to consider when you apply for a Personal Loan

When you decide to apply for a personal loan, it’s important to keep a few key considerations in mind to ensure a smooth process. Here are some helpful tips to optimize your loan application:

Tip 1: Assess your financial needs: Before you apply for a personal loan, carefully evaluate the specific amount you require and how it aligns with your financial situation.

Tip 2: Research and compare lenders: Look for reputable institutions offering competitive rates and flexible repayment terms, considering factors such as interest rates, loan features, and customer reviews.

Tip 3: Honour the repayments: To maintain a good credit score, it is crucial to avoid defaulting on any other interest or repayment obligations when seeking a loan apply instantly.

Tip 4: Borrow only what you need: Resist the temptation to borrow more than necessary. Assess your needs and borrow an amount that aligns with your requirements.